CriteriaCaixa aligns its 2025-2030 strategic plan with that of ”la Caixa” Foundation

05.11.25

3 minutes readBased on a reasonable forecast of its portfolio's profitability, CriteriaCaixa will have an investment capacity of up to €8 billion and plans to make more than €4 billion in social dividends available to ”la Caixa” Foundation, to be allocated to social programmes, research and scholarships, and cultural initiatives. CriteriaCaixa will focus its investments on projects that generate recurring, sustainable, and responsible returns. It will also promote value creation in its investee companies with a long-term vision.

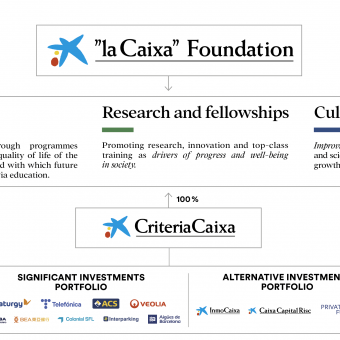

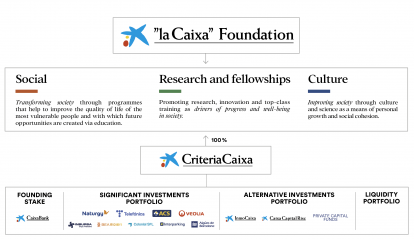

The Board of Directors of CriteriaCaixa, Spain’s leading investment holding that manages the business assets of ”la Caixa” Foundation, has approved the adaptation of its Strategic Plan to the one presented by the Foundation last June.

Based on a reasonable forecast of its portfolio's profitability, CriteriaCaixa will have an investment capacity of up to €8 billion and plans to make more than €4 billion in social dividends available to the Foundation until 2030, for use in social programmes, research and scholarships, and cultural initiatives.

With the aim of preserving and growing the Foundation's assets, CriteriaCaixa will focus its investments on projects that generate recurring, sustainable, and responsible returns. It will also promote value creation in its investee companies with a long-term vision.

During the presentation of the adapted Strategic Plan to employees, the Chairman of ”la Caixa” Foundation and of CriteriaCaixa, Isidro Fainé, stated: “This revised roadmap maintains the same direction we have always pursued: to generate dividends and grow the Foundation's assets in order to continue strengthening the capabilities of the Social Welfare programme, which has been, is, and will remain our hallmark. This will be achieved through responsible and sustainable investment policies that maximise positive social impact.”

José María Méndez, the General Manager of CriteriaCaixa, highlighted the holding company's great responsibility as manager of the Foundation's assets and the “importance of rigour and independence in decision-making, as well as excellence in investment analysis processes, effectiveness in management, and efficiency in results. Our objective is the creation of long-term value and the social dividend that enables the Foundation's transformative work.” He also expressed this appreciation to “the entire CriteriaCaixa team for their commitment to this purpose and to the organisation’s values, which make us a unique player in the European investment ecosystem.”

Focus on four investment portfolios

CriteriaCaixa has also reorganised its investment management around four main portfolios:

- Founding Stake:Through its representation on the

governing bodies, CriteriaCaixa will manage its stake in CaixaBank, a

financial institution that shares the same historical origins as ”la

Caixa” Foundation and underlines its heritage as a banking foundation.

CriteriaCaixa will maintain a minimum stake of 30% in CaixaBank.

- Significant Investments Portfolio: This portfolio will consist of competitive, preferably listed companies that operate in key sectors of the economy, with prospects and an industrial vision, and that seek to generate sustainable value through an appropriate balance between shareholder return and business growth. In these companies, CriteriaCaixa aims to be a reference shareholder and to exercise influence through its participation in their governing bodies will foster and support value creation with a long-term vision and commitment, while also promoting cooperation between the companies’ social initiatives and those conducted by ”la Caixa” Foundation.

- Alternative Investments Portfolio: This will include real estate assets aimed at generating recurring income and potential appreciation; financial holdings in third-party funds investing in unlisted companies and projects with a focus on growth and longer-term liquidity; and direct investments or investments through third-party funds in early-stage companies, primarily in the technology and biotechnology sectors. Investing in third-party funds will allow CriteriaCaixa to expand the number of companies it impacts, diversify risk, and maintain an active, albeit indirect, involvement in management. The objective is to maintain an alternative investments portfolio whose gross value does not exceed 10% of total gross asset value.

- Liquidity Portfolio: Aimed at maintaining available funds to meet short-term needs and commitments, both for daily operations and potential investments. CriteriaCaixa, directly and/or through third parties, will invest this portfolio in financial products with a conservative risk-return profile and adequate liquidity. The objective is to maintain an adequate liquidity portfolio whose gross value remains at least 10% of total gross asset value.

As of 30 June 2025, CriteriaCaixa's total Gross Asset Value reached €37.2 billion, in a first half of the year marked by the positive performance of its investee companies and solid cash generation driven by the dividends received from them (€1.07 billion). By June, the company had distributed a social dividend of €360 million to the Foundation in 2025, together with an additional €125 million approved by the Foundation's Board of Trustees on 9 October.

Conservative Financial Profile and Maintenance of Investment Grade Rating

CriteriaCaixa will maintain a conservative financial profile, with moderate debt levels - net medium-term debt of no more than 10% of total gross asset value - and diversified funding sources, including access to institutional debt markets. Another objective of the holding company is to maintain its Investment Grade rating.

Corporate Development

The Plan also incorporates a series of cross-cutting projects to foster the holding company's corporate development. These projects will be developed in the areas of people, technology, sustainability, and communication, with a 2030 horizon.